The Impact of the FLSA Overtime Rule on Higher Education

This report was made possible with the support of

By Sarah Nadel, Adam Pritchard, and Anthony Schmidt | October 2019

Introduction

The U.S. Department of Labor (DOL) enforces the Fair Labor Standards Act (FLSA), which is the law that sets federal minimum wage and overtime pay requirements. The FLSA specifies that for an employee to be considered exempt from overtime pay requirements as a white-collar worker, the employee must: (1) be paid on a salary basis; (2) be paid at or above a minimum weekly salary; and (3) perform job duties that DOL finds are consistent with executive, administrative or professional work.

In 2004, DOL set the minimum salary threshold for the white-collar exemption at $455 per week, or $23,660 per year. In 2016, DOL set a new threshold, which caused many higher education institutions to realign their exempt and nonexempt employees to meet the new threshold standards. However, just two weeks before the 2016 threshold was to take effect, a federal court issued an injunction preventing DOL from enforcing the new threshold. This meant the 2004 threshold remained in place.

In March 2019, DOL proposed a new salary threshold of $679 per week, or $35,308 per year.1U.S. Department of Labor, Wage and Hour Division. (n.d.) Notice of Proposed Rulemaking: Overtime Updates (Online Article). In September 2019, DOL issued a final rule, which goes into effect on January 1, 2020, and sets the salary threshold for the white-collar exemption at $684 per week, or $35,568 per year.2U.S. Department of Labor, Wage and Hour Division. (n.d.) Final Rule: Overtime Update (Online Article).

This report details the history of the salary threshold, changes higher ed institutions made based on the 2016 proposed salary threshold, and the implications of the newly updated overtime (OT) rule for higher education.

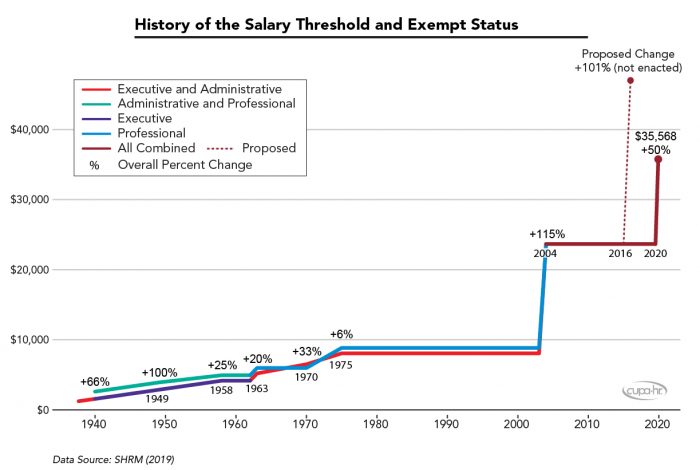

History of the Salary Threshold

DOL enacted the FLSA in 1938 to govern and establish rules and regulations regarding minimum wage, recordkeeping, hours worked, child labor, and OT pay.3Grossman, J. (n.d.) Fair Labor Standards Act of 1938: Maximum Struggle for a Minimum Wage (Online Article). The OT pay provisions require employers to pay employees for hours worked over 40 in a workweek at a rate not less than one-and-one-half times the regular rate of pay, unless the employee is exempt from the requirement.4Read more about the DOL’s regulations on exempt vs. nonexempt status, overtime regulations and the salary threshold. Nonexempt employees are paid hourly; for those that work an excess of 40 hours per week, they earn time and a half for each hour worked beyond 40. Exempt employees are paid a set salary, with an understanding that their workweek hours may vary, and no OT is paid.

In October 1938, the first official salary threshold was established at an annual rate of $1,560 per year for executive and administrative exemptions only. Two years later, the salary threshold increased to $2,600 per year for executive and administrative exemptions, while professional exemptions were set at $1,560 per year. In 1949, DOL increased the salary threshold to $5,200 per year for all three exemptions. Between 1949 and 1975, there were four more increases, totaling $11,000 per year overall.

Before 1975, the salary threshold had been reviewed a minimum of every nine years; however, after 1975, it wasn’t until 2004 that the salary threshold was increased. In 2004, the salary threshold was set at $23,660 per year for both executives and professionals. In 2016, DOL set a new salary threshold of $47,476 per year — an increase of 101 percent from 2004 to 2016. However, two weeks before the new threshold would have gone into effect, a federal court enjoined DOL from enforcing it. Nonetheless, in anticipation of the 2016 threshold, many higher education institutions had already begun to make changes to their workforce by realigning the salaries and classifications of certain employees.

On September 24, 2019, DOL set the new salary threshold at $35,568 per year (Figure 1).5Society for Human Resource Management (2019). Timeline: Overtime Rule History (Online Article). Employers have until January 1, 2020, to comply.

Figure 1. History of the Salary Threshold and Exempt Status

Impact on Exempt Status and Salaries of Professional Employees

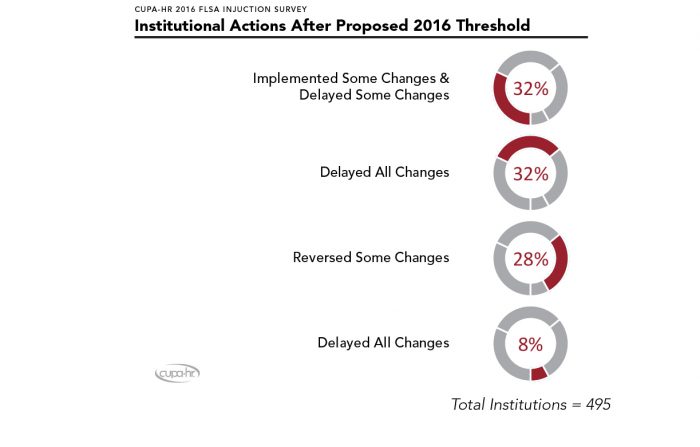

In December 2016, CUPA-HR collected data in the FLSA Injunction Responses Survey to identify the number of institutions who were in one of four distinct categories: those who planned to move forward with implementing some changes while delaying other changes, those who decided to delay all changes, those who moved forward with implementing all changes, and those who planned to reverse some changes (Figure 2).

Figure 2. Institutional Actions After Proposed 2016 Threshold

Now that the new OT rule has been finalized, with an implementation date of January 1, 2020, institutions must once again begin the process of planning and implementing changes based on the ruling. Because the threshold in the 2019 final rule is $35,568 per year, which is significantly lower than the 2016 amount of $47,476 per year, there are fewer professional employees who fall below the new salary threshold.6Bichsel, J., Pritchard, A., & McChesney, J. (2019). Professionals in Higher Education Annual Report: Key Findings, Trends, and Comprehensive Tables for the 2018-19 Academic Year (Research Report). CUPA-HR.

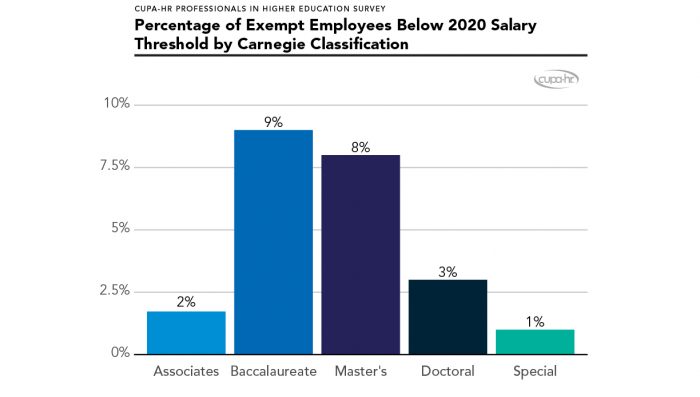

Around 5% of professional exempt employee salaries currently fall below the new salary threshold of $35,568 per year.7Ibid. Figure 3 identifies the percent of exempt professional employees in each Carnegie classification who are paid below the new salary threshold, suggesting that baccalaureate and master’s institutions have the most exempt employees who were paid below the threshold at the start of the 2018-19 academic year.

Figure 3. Percentage of Exempt Employees Below 2020 Salary Threshold by Carnegie Classification

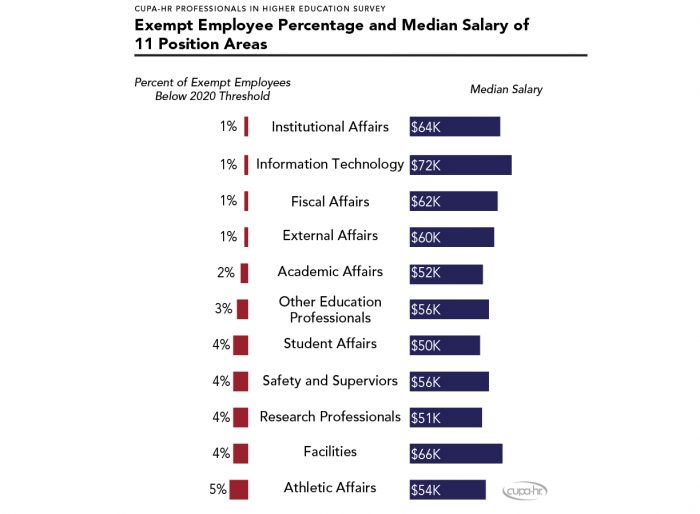

To further examine the impact of the new salary threshold, 11 position areas were identified as being the most impacted due to the salary threshold changes.8Bichsel, J., Pritchard, A., & McChesney, J. (2019). Professionals in Higher Education Annual Report: Key Findings, Trends, and Comprehensive Tables for the 2018-19 Academic Year (Research Report). CUPA-HR. These position areas include: Student Affairs, Research Professionals, Academic Affairs, Athletic Affairs, Safety and Supervisors, Other Education Professionals, External Affairs, Fiscal Affairs, Institutional Affairs, Facilities, and Information Technology.

Figure 4 provides additional information about these position areas. The percentage of incumbents whose salary is below the January 1, 2020, salary threshold and the 2019 median salaries of each position area are identified. Within all 11 position areas, between 1% and 5% of incumbents earn less than the new salary threshold amount. This is a vast difference from the 2% to 18% of incumbents whose salary fell below the 2016 proposed salary threshold within these positions.9Ibid.

Figure 4. Exempt Employee Percentage and Median Salary of 11 Position Areas

Next Steps

The salary threshold has now been established at $35,568 per year, and institutions are required to enact the necessary changes by January 1, 2020. Reclassification of employees, budgetary considerations, and OT policy reviews are potential impacts that may require new decisions to be made to adjust to the new threshold.

CUPA-HR’s advocacy web page includes resources including DOL fact sheets, DOL Q&As, webinar information, and more.10Additional information and resources regarding the new overtime rule. The FLSA toolkit in CUPA-HR’s online Knowledge Center11CUPA-HR’s Knowledge Center FLSA Overtime Toolkit. provides an overview of the FLSA; offers guidance on FLSA compliance, FLSA exposure, and FLSA record keeping requirements; provides a link to DOL OT calculators; and contains forms and templates that can be utilized for notifying employees about the changes to the overtime rule.

Now that the new OT rule is set, institutions must identify which positions are or will remain exempt versus those that will now be classified as nonexempt. DOL Fact Sheet #17A defines the executive, administrative, and professional exemptions based on requirements that must be met to be considered exempt, irrespective of salary.12Department of Labor. (2008). Fact sheet #17A: Exemption for Executive, Administrative, Professional, Computer and Outside Sales Employees Under the Fair Labor Standards Act. This worksheet can help institutions understand how to properly classify positions as exempt or nonexempt considering the new salary threshold along with other job duties.

Addressing the changes needed to employees’ salaries and exempt status may be challenging for higher education institutions. However, the tools needed to successfully overcome this challenge can be found through increased awareness of all aspects of the ruling, communication, education, CUPA-HR resources, and the DOL website.

Change is inevitable, but with preparation and a plan of action, institutions can successfully meet all FLSA requirements.

Citation for this report: Nadel, Sarah; Pritchard, Adam; & Schmidt, Anthony (2019, October). The Impact of the FLSA Overtime Rule on Higher Education (Research Report). CUPA-HR.

Printer-friendly Version 1 U.S. Department of Labor, Wage and Hour Division. (n.d.) Notice of Proposed Rulemaking: Overtime Updates (Online Article).

2 U.S. Department of Labor, Wage and Hour Division. (n.d.) Final Rule: Overtime Update (Online Article).

2 U.S. Department of Labor, Wage and Hour Division. (n.d.) Final Rule: Overtime Update (Online Article).

3 Grossman, J. (n.d.) Fair Labor Standards Act of 1938: Maximum Struggle for a Minimum Wage (Online Article).

3 Grossman, J. (n.d.) Fair Labor Standards Act of 1938: Maximum Struggle for a Minimum Wage (Online Article).

4 Read more about the DOL’s regulations on exempt vs. nonexempt status, overtime regulations and the salary threshold.

4 Read more about the DOL’s regulations on exempt vs. nonexempt status, overtime regulations and the salary threshold.

5 Society for Human Resource Management (2019). Timeline: Overtime Rule History (Online Article).

5 Society for Human Resource Management (2019). Timeline: Overtime Rule History (Online Article).

6 Bichsel, J., Pritchard, A., & McChesney, J. (2019). Professionals in Higher Education Annual Report: Key Findings, Trends, and Comprehensive Tables for the 2018-19 Academic Year (Research Report). CUPA-HR.

6 Bichsel, J., Pritchard, A., & McChesney, J. (2019). Professionals in Higher Education Annual Report: Key Findings, Trends, and Comprehensive Tables for the 2018-19 Academic Year (Research Report). CUPA-HR.

7 Ibid.

7 Ibid.

8 Bichsel, J., Pritchard, A., & McChesney, J. (2019). Professionals in Higher Education Annual Report: Key Findings, Trends, and Comprehensive Tables for the 2018-19 Academic Year (Research Report). CUPA-HR.

8 Bichsel, J., Pritchard, A., & McChesney, J. (2019). Professionals in Higher Education Annual Report: Key Findings, Trends, and Comprehensive Tables for the 2018-19 Academic Year (Research Report). CUPA-HR.

9 Ibid.

9 Ibid.

10 Additional information and resources regarding the new overtime rule.

10 Additional information and resources regarding the new overtime rule.

11 CUPA-HR’s Knowledge Center FLSA Overtime Toolkit.

11 CUPA-HR’s Knowledge Center FLSA Overtime Toolkit.

12 Department of Labor. (2008). Fact sheet #17A: Exemption for Executive, Administrative, Professional, Computer and Outside Sales Employees Under the Fair Labor Standards Act.

12 Department of Labor. (2008). Fact sheet #17A: Exemption for Executive, Administrative, Professional, Computer and Outside Sales Employees Under the Fair Labor Standards Act.