Benefits in Higher Education Survey Methodology, 2023-24

The data collection period for CUPA-HR’s Benefits in Higher Education Survey ran from November 1, 2023, to January 18, 2024. The survey was conducted through Surveys Online.[1]

DATA COLLECTED

This year’s survey was completed by 324 institutions. Participants entered data manually and were given the instruction to report benefits information for regular full-time employees as of January 1, 2024 (projected if necessary).[2] Where a question does not collect information on whether benefits offerings differ by employee type (e.g., staff vs. faculty), participants entered data for the program or policy that applied to the greatest number of regular full-time employees.

The following data were collected:

General Healthcare Data

General questions consisted of the following:

- Whether healthcare plans are provided through a private health insurance exchange

- Whether the institution offers health benefits to the following and if so, whether the institution pays part of the premium:

- Staff retirees under 65

- Staff retirees over 65

- Faculty retirees under 65

- Faculty retirees over 65

- Part-time staff

- Part-time faculty

- Whether dependent health benefits are offered to same-sex or opposite-sex domestic partners

- If a salary-based system is used to determine healthcare premiums

- Whether the institution offers healthcare or dependent care flexible spending accounts

- If the institution provides access to on-campus medical services and if yes, whether a user fee is incurred

- If the institution provides access to an on-campus fitness center and if yes, whether a user fee is incurred

- Whether healthcare coverage is offered for spouses or partners who are eligible for coverage elsewhere and if so, whether a surcharge is imposed

Details on Healthcare Plans

For Preferred Provider Organization (PPO), Health Maintenance Organization (HMO), Point of Service (POS), and High Deductible Health (HDH) plans, the following data were collected:

- Percentage of employees enrolled in each plan offered

- Plan funding: fully-insured or self-insured

- Whether plan includes the following:

- Dental insurance

- Vision insurance

- Employee and institution monthly premium amounts, annual deductible amounts, and annual out-of-pocket maximum amounts for the following categories where offered:

- Employee only

- Employee + Spouse

- Employee + Child(ren)

- Employee + Family

- Percentage of allowable charges paid by the plan and by the employee after deductibles and co-pay for a) in-network benefits and b) out-of-network benefits

- Whether prescription drug plans (when offered):

- Require a co-pay

- Use a closed formulary

- Require mail order

- Provide Rx benefits for dental or dental trauma

- Cover oral contraceptives

- Cover contraceptive devices

- Cover fertility drugs

- Cover erectile dysfunction drugs

- Cover diabetic supplies

- Provide incentives for using mail order for maintenance drugs

For stand-alone dental plans, the following data were collected:

- Employee and institution monthly premium amounts, annual deductible amounts, and annual maximum plan benefit amounts for the following categories where offered:

- Employee only

- Employee + Spouse

- Employee + Child(ren)

- Employee + Family

- Details on orthodontics coverage

For stand-alone vision plans and long-term care plans, the following data were collected:

- Percentage of employees enrolled in each plan offered

- Whether the institution pays part of the premium

Wellness Programs

Institutions designated whether they had a wellness program in place and if not, whether they had plans to develop a wellness program within the next year. Those with a wellness program in place were asked the following:

- Whether there’s a separate budget for the wellness program and if so, the budget amount

- Whether there are dedicated staff for the wellness program and if so, the staff FTE dedicated

- The area responsible for administering the wellness program

- Whether the wellness program contains the following components:

- Physical wellness education

- Physical wellness activities

- Physical wellness tracking

- Financial wellness education

- Financial wellness activities

- Financial wellness tracking

- Mental wellness education

- Mental wellness activities

- Mental wellness tracking

- Whether any of the following incentives for participating are provided:

- Discount on health insurance and if so, the percentage discount

- Financial incentive other than a health insurance discount

- Non-financial incentive

- Whether employees must do any of the following to be considered a participant in the wellness program:

- Get a wellness screening

- Take a health risk assessment

- Get a blood screening

Dependent Care

- Whether institution provides a Dependent Care Assistance Plan

- Whether institution provides employees the following:

- Childcare referral services

- Backup childcare

- Onsite childcare

- Grants, subsidies, or other funds toward childcare costs

- Amount if grants, subsidies, or other funds are provided toward childcare costs

- Whether institution provides employees the following:

- Elder care referral services

- Backup elder care

- Onsite elder care

- Grants, subsidies, or other funds toward elder care costs

- Amount if grants, subsidies, or other funds are provided toward elder care costs

Paid Time Off (PTO)

- Whether institution provides unlimited paid time off (PTO)

- Number of paid holidays each year

- Which paid holidays are offered

- Whether institution has a formal PTO plan that combines vacation and sick leave or other benefits

- Number of PTO days

- PTO accrual limits

- Whether unused sick leave is paid upon retirement or employment separation

- Number of personal days

- Information on paid leave for new parents

- Information on short-term disability leave

Tuition Benefits and Student Loan Repayment Assistance

- Availability of tuition benefits for employees

- If offered to employees, minimum length of service required, number of credit hours eligible for assistance, and whether employees can attend classes during working hours

- Whether benefits are eligible for use in undergraduate or graduate courses

- Availability of tuition benefits for part-time and outside-contracted employees

- Whether tuition benefits can be used at other institutions

- Availability of tuition benefits for spouses, domestic partners, and children of full-time employees, minimum length of service required, and number of credit hours eligible for assistance

- Percentage of employees receiving tuition benefits

- Percentage of exempt vs. non-exempt employees receiving tuition benefits

- Whether institutions help employees repay student loans

Retirement

- Whether institution offers phased retirement or retirement incentive programs, and whether programs were added or expanded in response to the COVID-19 pandemic

- Number of plans available to full-time employees

- Whether more than one retirement services provider is used and how many are authorized to receive institution contributions

- Types of retirement plans offered (traditional defined benefit, cash balance, 403(b), 457(b), 401(a), 401(k))

- For each retirement plan offered: funding type (i.e., state employee plan, self-funded, or purchased insurance product), whether participation is mandatory, whether the plan is primary or supplemental, waiting period, mandatory employee contribution, institution contribution

- Primary retirement plan information: whether participation is mandatory, employer matching contribution, employer non-matching contribution, vesting period, number of loans allowed

- SECURE 2.0-related policies, such as whether institutions allow penalty-free distributions for employees who experience a qualified disaster or survive domestic abuse

Institutional Basics

Basic data on institutional characteristics were collected from all participants:

- Total expenses reported to IPEDS in 2022-23

- Student enrollment (effective date approximately October 15, 2023)

- Faculty size (effective date November 1, 2023) and number of separations in the past year

- Staff size (effective date November 1, 2023) and number of separations in the past year

- Human resources staff size and number of separations in the past year

- CHRO reporting relationship

- Whether collective bargaining exists for the following groups:

- Full-time faculty

- Part-time or adjunct faculty

- Full-time staff

- Graduate students

Basic information on total expenses as well as student, faculty, and staff size were required questions. All other questions were optional.

RESPONDENTS

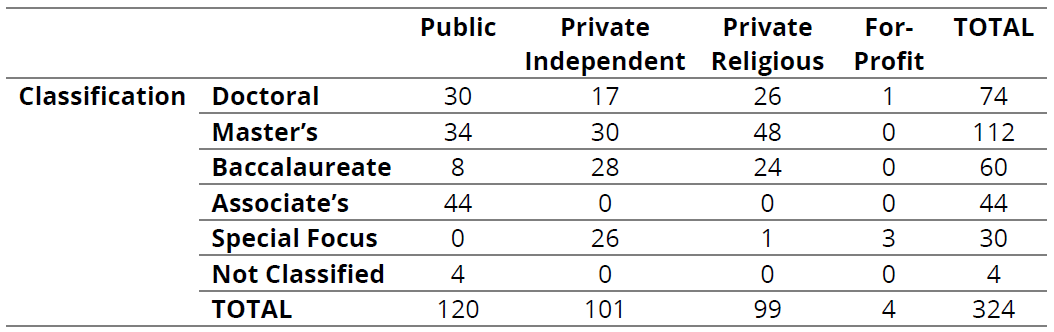

Respondents were largely human resources professionals from higher education institutions in the U.S. There were 324 institutions that completed the survey.[3]

CITATION INFORMATION

CUPA-HR. (2024). Benefits in Higher Education Survey, 2023-24 [Data set].